PHONE # 262.884.8890

Resources

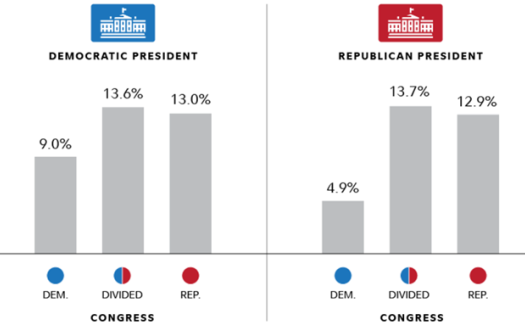

What investors should know about markets and election years...

With Election Day quickly approaching, it's natural for investors to question potential impacts on the market. This week our focus shifts to examining the historical data (performance of the S&P 500) relating to election years and cycles. In the midst of heightened emotions (on both sides of the aisle), the actual impact on the market may be less than investors and voters realize. Let's examine five key takeaways as investors navigate ...

Productivity - A Key Contributor to U.S. Stock Performance

What causes one country's stock market to outperform others? Over longer periods (more than five years), higher relative earnings growth is the primary driver. Earnings are influenced by two main factors: revenue growth and profit margins. Countries with higher GDP growth, or those fostering a culture that advances and supports innovation foster greater opportunities for growth. Companies capable of generating demand where it previously ...

Fed Recalibrates - Cuts Rate by Half-Point

On Wednesday, September 18th, the Federal Reserve recalibrated monetary policy and surprised many on Wall Street with a half-point cut, bringing its target range to 4.75% to 5.00%. With inflation easing, the Federal Reserve announced a 50 basis point cut to its benchmark interest rate--- representing the first reduction in borrowing costs since March of 2020. In the press conference that followed the Fed's rate-change announcement ...

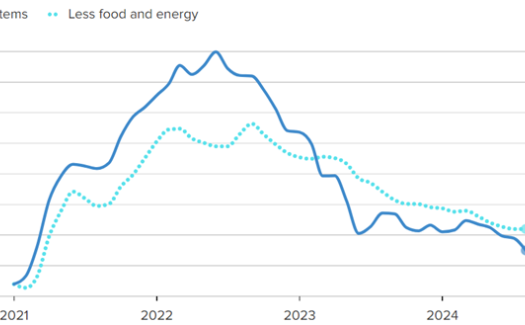

August CPI Data & Anticipated Rate Cut

On Wednesday, September 11th, the Labor Department released August's Consumer Price Index (CPI) data and reporting. The Consumer Price Index represents a broad measure of goods and services across the United States economy. Here are the key summary points investors should note from this past Wednesday's report: * The Consumer Price Index increased 0.2% for the month of August. This figure was in line with Dow Jones consensus and ...

Market Recap & Insights Heading into September 2024

At Lighthouse Wealth Partners, we value ongoing communication in an effort to provide investors with key economic reporting and market insight to help guide your investment decisions. This week our focus turns to the month of September which has presented seasonal challenges in the past, especially in recent years. While September's historical data is hard to ignore, it is important to note the strong market recovery as August closed ...

5 Common Money Mistakes

At Lighthouse Wealth Partners, we value ongoing communication in an effort to provide investors with key economic reporting and market insight to help guide your investment decisions. This week, in collaboration with Fidelity, our custodial partner, we examine 5 common money missteps. Working to avoid these mistakes can help ensure investors are good stewards of the dollars entrusted to their care. Let's take a look at the traps to ...