Estate Planning

Decisions you can make today to best prepare for tomorrow’s uncertainties. Let’s look at five key areas of focus:

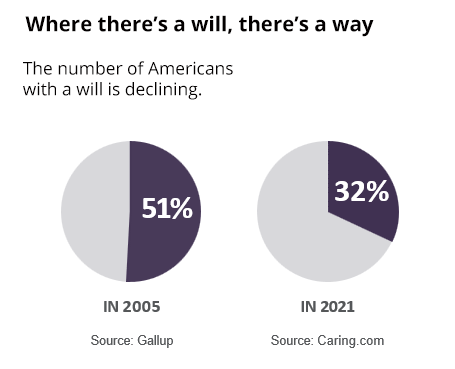

Wills & Trusts

A will is a legal document that outlines your wishes for how your assets should be distributed after you pass away. In addition, it names an executor to handle the distribution process while appointing guardians for any minor children you may have. Wills are generally subject to probate, which is a court-supervised process for settling an estate and ensuring that the will’s instructions are followed.

A will is a legal document that outlines your wishes for how your assets should be distributed after you pass away. In addition, it names an executor to handle the distribution process while appointing guardians for any minor children you may have. Wills are generally subject to probate, which is a court-supervised process for settling an estate and ensuring that the will’s instructions are followed.

On the other hand, a living (or revocable) trust is drafted during your lifetime and can be modified or revoked at any time. It holds your assets while you’re alive and provides instructions for how your assets should be managed and distributed after you pass away. One of the most notable advantages of a living trust is that it allows your estate to avoid the probate process, saving time, money, and potential conflicts.

| Attribute | Will | Trust |

|---|---|---|

| Time-frame | Goes into effect after passing away | Goes into effect while you're living |

| Privacy | Public record - also involves probate | Avoids probate - maintains privacy |

| Flexibility | Can be amended or revoked while alive | Can also be amended or revoked |

| Authority | Names and designates Executor | Names and designates Trustee |

| Cost & Complexity | Generally less expensive and simpler | Generally more detailed |

| Home-Property | Deed transfer service available | Deed transfer incorporated |